- Home

- Blog

- Currency News

- What’s the Impact on the Pound?

Election Results: What’s the Impact on the Pound?

٤ ديسمبر ٢٠١٩ — 3 min read

The UK is heading to the polls on the 12th December to cast their ballots for the so-called ‘Brexit election’, as voters decide who will be the next Prime Minister.

We’ve seen the Pound rise and fall as new poll data is released. The markets yesterday were abuzz with the news of the Pound strengthening, as the Conservative Party widened their lead to 12 points over Labour.

Below, our experts look at how the Pound could be impacted following the Election results. You could look to consider your upcoming money transfers so that you can transfer at a time the works best for you.

How could the Election results impact my GBP transfers?

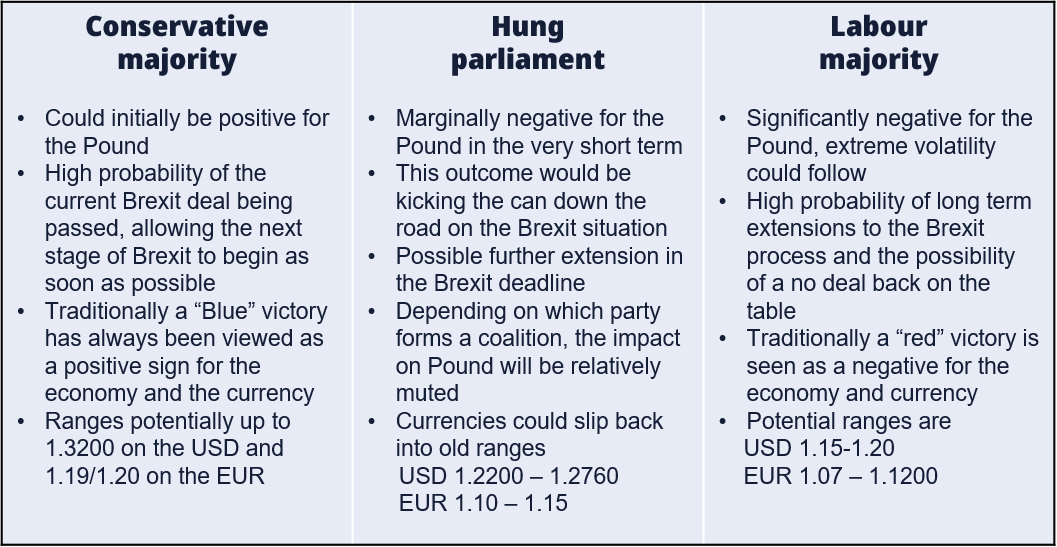

The growing likelihood seems to be between a Conservative majority or a hung parliament, but polls have been wrong in the past. Our experts look at how the Pound could react following the Election results on the 13th December.

These figures are based on the live mid-market rate and are provided for indicative purposes only. Live mid-market rates are not available to consumers and are for informational purposes only. The rates we quote for money transfer can be selected by logging in to your account and getting a quote.

Essentially, markets like certainty, and a Conservative majority government brings more certainty around Brexit.

However, markets are nervous as the results can easily change. In 2017 we saw Theresa May’s gamble at the elections result in an unexpected hung parliament. This is why traders are keeping a close eye on poll results and explains why we see a drop in the Pound when Jeremy Corbyn narrows the gap against the Conservatives. A hung parliament could lead to more Brexit uncertainty and uncertainty is likely to cause volatility in the market.

If you’re looking for a particular rate at which to transfer, you can set up a Rate Alert by logging in to your Money Transfer account, and you'll be alerted when your desired rate is reached.

We can be your eyes and ears in the market, with a range of currency tools to help you monitor market movements. If you’d like to discuss your situation with us in more detail, please contact us and our team will be happy to help.

The information, materials, accompanying literature and documentation available on our internet site is for information purposes only and is not intended as a solicitation for funds or a recommendation to trade.

XE its officers, employees and representatives accept no liability whatsoever for any loss or damages suffered through any act or omission taken as a result of reading or interpreting any of the above information.

While we take reasonable care to keep the information on the website accurate and up to date, there may be occasions when this is not possible. Case Studies and articles are not intended to predict future moves in exchange rates or constitute advice. XE makes no representations, warranties, or assurances as to the accuracy or completeness of any information derived from third party sources. If you are in any doubt as to the suitability of any foreign exchange product that you are intending to purchase from XE, we recommend that you seek independent financial advice first.

Related Posts

٣ ديسمبر ٢٠٢٤ — 4 min read

٦ نوفمبر ٢٠٢٤ — 5 min read

٢٢ أكتوبر ٢٠٢٤ — 6 min read

١٥ أكتوبر ٢٠٢٤ — 5 min read

١٠ سبتمبر ٢٠٢٤ — 2 min read

١٣ أغسطس ٢٠٢٤ — 3 min read