- Home

- Blog

- Currency News

- Q2 in review and looking ahead to H2

The US Dollar in 2021: Q2 in review and looking ahead to H2

One thing is clear from 2021’s first six months—the FX markets and the US Dollar found a new trading theme. This theme? Inflation.

٢٨ يونيو ٢٠٢١ — 4 min read

By Ron Vodicka, Corporate FX Dealer – North America

One thing is clear from 2021’s first six months—the FX markets and the US Dollar found a new trading theme. This theme? Inflation.

While 2020 was dominated by the massive USD safe-haven rally at COVID’s onset and the subsequent slow, steady unwinding of this safe-haven premium, January 2021 brought a market “reset” of sorts. FX traders that had been inculcated with 2020’s COVID-19 “risk-on vs. risk-off” trading doctrine shifted gears with the onset of vaccines and began thinking about the US economy’s reopening and mulling the one potential pitfall: the resurgence of inflation.

Moving into the new year, it was becoming clear the COVID-19 lockdowns and workplace responses impacted the market with supply chain disruptions and brewing inflation. Producers that had been forced to scale back production with COVID’s demand shrinking, were now experiencing re-starting challenges which influenced the supply chain. Issues ranging from commodity shortages to uncertain labor pools as demand began to resurface had businesses competing for scarce resources, thus stoking inflation.

How did this impact the US Dollar?

As traders began anticipating inflation, they also began betting the Federal Reserve needed to raise interest rates to fight inflation…and off to the races it was for US bond yields!

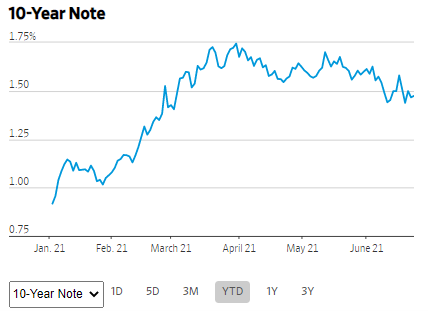

Starting in late January to mid-April, the US 10-year bond rose 100 basis points, going from 0.75% to 1.75% in a dramatic move. This US yield curve rise overshadowed yield rises from the UK, the EU, Canada and more, and the US dollar soared on these new interest rate differentials. From that period in January to April, the US Dollar Index rose +4%.

USD 10-Year Note chart courtesy of the Wall Street Journal

Since then, all markets have been focused on inflation with the FX market especially focused on relative yield differentials. In the US, from mid- April until June, the bond yield rally took a pause, as markets began wondering if the yield rally had gone a bit too far, too fast. Further, the US Federal Reserve continued its mantra that the inflation being seen is “transitory”, a temporary spike as the economy adjusts to re-opening. During this time, the USD Index gave back 3/4 of its earlier gains and the 10-year bond dropped 25 basis points to 1.50%.

And, thus was born 2021’s primary USD theme: inflation, and where will it go from here.

What’s next for the USD?

Looking at the various markets (rates, equities, commodities, FX) there are two divergent views of what will happen next—those believe that inflation is not temporary, and those that believe it is.

Should inflation prove real, then the Fed would likely tighten policy, and the USD should rally in response. Last week’s market response to the FOMC meeting was evidence of this as the USD spiked 2.5% in just 48 hours.

Conversely, should time prove the Fed right, that inflation is transitory, then there’s a lower likelihood of rate hikes sooner than expected, and this should weaken the USD.

Looking beyond interest rate yield differentials

Of course, a currency’s value is the sum of a collection of factors, not just interest rate differentials. Beyond interest rates, there’s lot of good happening in the US economy that should help make the USD attractive.

COVID vaccinations are showing signs of success and the US is moving towards “herd immunity”

The economy is re-opening with explosive GDP growth expected in 2H21

Fiscal stimulus is robust

Equity markets are holding firm near all-time peaks

The US consumer seems healthier than ever.

All of this points to the US being an attractive market to place capital.

What could possibly go wrong?

The most looming issue pressing the US economy and the US Dollar is the prospect of the Federal Reserve losing control of inflation. With all the fiscal stimulus, the US’s Debt-to-GDP ratio is now higher than it was after World War II. Equity market valuations are at record highs but also record multiples. The challenge the Federal Reserve faces (as do other central banks) is working to control inflation without destroying the economy that has been built on their ultra-easy monetary policies.

As always, only time will tell the story of what happens to the US Dollar. Right now, its value is highly hinged on interest rate expectations around the topic of inflation. We will see where this story goes.

Related Posts

٣ ديسمبر ٢٠٢٤ — 4 min read

٦ نوفمبر ٢٠٢٤ — 5 min read

٢٢ أكتوبر ٢٠٢٤ — 6 min read

١٥ أكتوبر ٢٠٢٤ — 5 min read

١٠ سبتمبر ٢٠٢٤ — 2 min read

١٣ أغسطس ٢٠٢٤ — 3 min read