- Home

- Blog

- Currency News

- EUR Breaches 1.1500—What to Think?

Currency Market Update: EUR Breaches 1.1500—What to Think?

Following the signing of the EU’s spending package, EURUSD has breached 1.1500 this morning. What is going on, and how should one interpret this?

July 21, 2020 — 2 min read

By Ron Vodicka, Corporate Sales Team Lead, North America

Following the signing of the EU’s EUR 1.8 trillion (US$2.1 trillion) spending package, EURUSD has breached 1.1500 this morning. What is going on, and how should one interpret this?

What’s going on?

Since the March 23rd peak of the COVID-19 crisis when U.S. equities hit their nadir and the USD Index its “safe-haven” zenith, the USD Index has been falling—and not always “steadily”. U.S. equities have come roaring back, fueled by both fiscal and monetary stimulus, which has had knock-on effects on the USD:

Risk-on market bullishness is triggering further unwinding of any remaining “safe-haven premium” built into the USD.

Expected U.S. economic sluggishness going forward has eliminated the U.S.’s “growth story” which is also denting the USD.

U.S. interest rate differentials have diminished with global central bank easing, also weakening the USD.

The USD often weakens heading into U.S. Presidential elections.

President Trump desires a weaker USD.

Looking at EURUSD specifically, today’s market move can be viewed by importers and exporters through two lenses: short-term and longer-term thinking.

Short-Term (1 month)

Exporters selling in EUR are getting an opportunity to sell EUR at short-term attractive levels.

The 1-month chart below shows EUR approaching the upper-trend line.

With Europe at negative rates, EUR sellers still get a slight premium for forward hedging.

Importers should look for dips but know that EURUSD is setting both higher highs and higher lows.

Keep an eye on the US equity markets for clues.

Longer-Term (5 years)

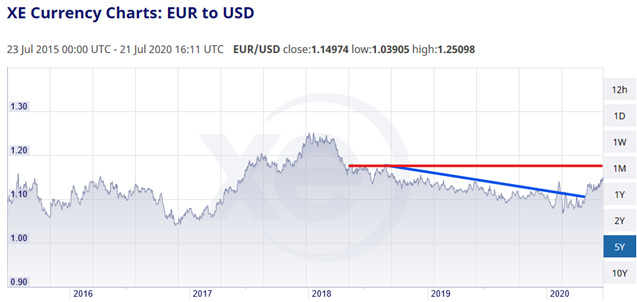

The blue line in the chart below shows how the 2-year EUR downtrend has been broken, which importers have loved.

The red line in the chart below shows that if EURUSD clears 1.1550, the next targets are towards 1.1680 to 1.1735.

It most likely won’t be a sprint back to 1.2000 or 1.2400 where it was in just 2018.

Importers should recognize the downtrend is broken and not hope for a return to 1.0600 anytime soon.

Related Posts

March 7, 2025 — 5 min read

February 28, 2025 — 5 min read

February 13, 2025 — 7 min read

February 11, 2025 — 7 min read

February 4, 2025 — 4 min read

January 28, 2025 — 4 min read