- Home

- Blog

- Money Transfer

- Identification Documents for KYC and KYB

Online Money Transfer Tips - Chapter Two: Identification Documents for KYC and KYB

June 24, 2019 — 4 min read

Preparing to register for your XE Money Transfer account, and considering starting process of initiating an online money transfer? XE is mandated by international financial regulators to collect and verify certain dentification documents. This is to comply with international Anti-Money Laundering regulations, which are enforced by regulatory organizations, such as:

● The Australian Securities and Investments Commission (ASIC)

● The New Zealand Financial Markets Association (NZFMA)

● The Financial Transactions and Reporting Analysis Centre of Canada (FinTRAC)

● US Department of Treasury Financial Crimes Enforcement Network (FinCEN)

● The Financial Services Authority in the UK

After you securely upload your documents to XE, our compliance team uses their resources to review them in accordance with Know Your Customer (KYC) regulations. Business transactions are governed by, you guessed it, Know Your Business (KYB) regulations, though these regulatory requirements are generally gathered under the umbrella term KYC.

KYC refers to the steps taken by a financial services providers like XE to:

Establish and verify customer identity

Understand the nature of financial activities

Assess risk

Protect individuals and businesses who are carrying out lawful transactions.

You'll often see the KYC acronym preceded by 'e' for electronic.

Putting KYC and KYB Into Context

Much like how you go through security before you board a plane for an overseas trip, the KYC process simply confirms your identity and the nature of your transfer. Odds are, your credentials will be reviewed, your reason for transfer will be cleared, and all will be well.

When financial authorities identify and halt identity thieves before they transfer money overseas before they act, it means:

Fewer cyber criminals are vicitimizing consumers and businesses

There are precedents and deterrents against money laundering and identity theft

Justice is served, consumers and businesses are protected

Transactions are completed with expected speed and reliability

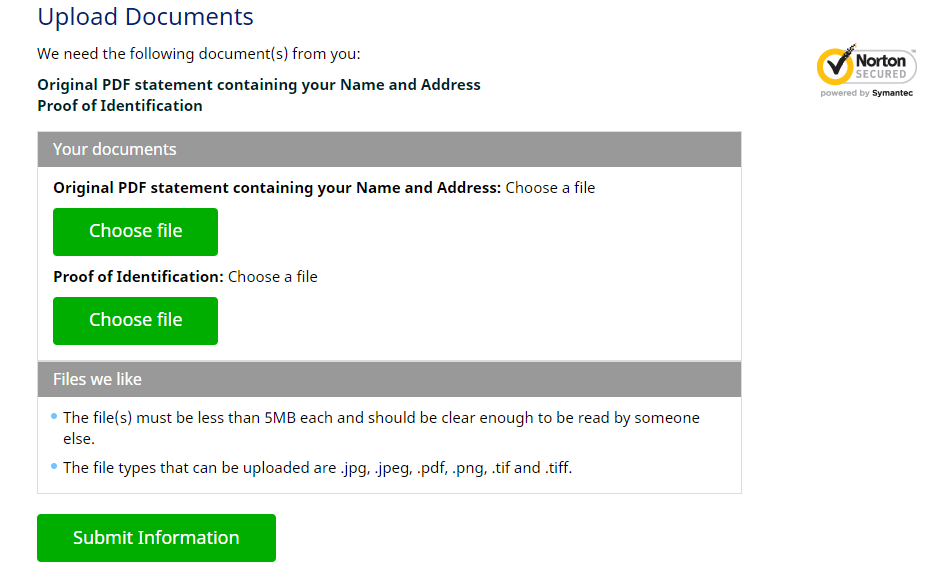

Here is a screenshot of the account page where XE customers upload their documents securely. If you are unsure which documents to use,

When XE complies with these regulations, it helps our customers, business partners, and employees by:

Reducing the occurrence of fraud in the financial services industry as a whole

Helping to assess and mitigate risk

Blocking illegal payments or money laundering before they happen

Online transfer services like XE.com are increasingly using purpose-built commercial tools to expedite the KYC identification verification processes for smaller transactions. For larger transfers, however, we are obliged by international to manually review identification documents.

In some countries like the United States some automated verification can be sourced by specialised AML technology providers that have access to billions of records, from around the world, such as:

Cellphone and utility invoices

Electoral rolls

National IDs

Consumer marketing databases

Property files

Depending on the size of your money transfer, online transfer services like XE.com can sometimes use purpose-built industry tools to expedite the identification verification process. For larger transfers, however, we are obliged by international to manually review identification documents.

The sooner you can provide clear, authentic identification documents through your account authentication page, the faster we can process your transfer, and get your money where it needs to be. Much like when you are travelling to another country you have to go through customs and security checks and inspections, KYC processes are preventative measures to halting unlawful transactions from happening.

Now you can do your part to ensure a seamless transfer experience, so sign up for an XE Money Transfer account, and request a free, no obligation quote today!

Please Note:

The information, materials, accompanying literature and documentation available on our internet site is for information purposes only and is not intended as a solicitation for funds or a recommendation to trade. XE, its officers, employees and representatives accept no liability whatsoever for any loss or damages suffered through any act or omission taken as a result of reading or interpreting any of the above information.

While we take reasonable care to keep the information on the website accurate and up to date, there may be occasions when this is not possible. Case Studies and articles are not intended to predict future moves in exchange rates or constitute advice.

XE makes no representations, warranties, or assurances as to the accuracy or completeness of any information derived from third party sources. If you are in any doubt as to the suitability of any foreign exchange product that you are intending to purchase from XE, we recommend that you seek independent financial advice first.

For more information about XE, please click here: Regulatory Information

Related Posts

December 31, 2024 — 6 min read

December 20, 2024 — 5 min read

December 6, 2024 — 7 min read

November 21, 2024 — 8 min read

November 7, 2024 — 8 min read

October 28, 2024 — 6 min read