- Home

- Blog

- Currency News

- US Dollar soars to its highest gain in years as Trump clinches victory

US Dollar soars to its highest gain in years as Trump clinches victory

November 6, 2024 — 5 min read

The U.S. dollar surged against nearly every global currency overnight as investors reacted to Donald Trump's strong performance in the polls.

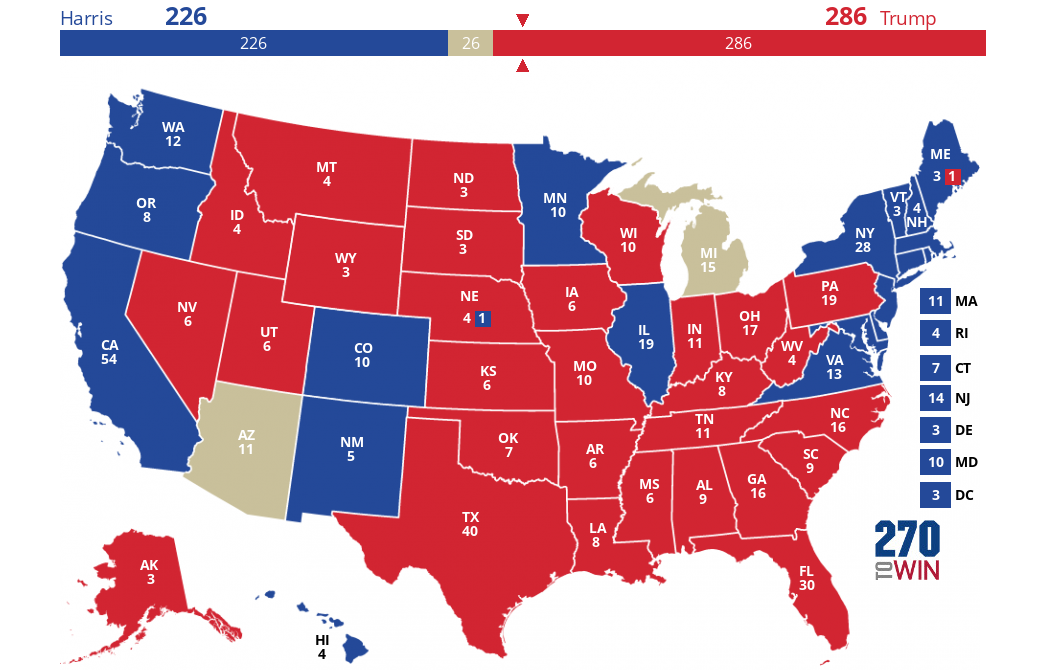

Following their presidential election victory, Republicans have also reclaimed the Senate, while the outcome in the House of Representatives remains uncertain. A Republican ‘clean sweep’ across the executive and legislative branches is now a strong possibility.

Map Updated: Nov. 6, 2024 at 17:32 UTC (12:32 PM EST)

Many are surprised by the extent of Trump’s win, especially given the close polling leading up to election day. But what could a second Trump presidency mean for the markets and the global economy?

The Currency team at Xe are already weighing in on the implications of this morning's news. Here’s a look at their early insights.

What’s next for currency markets?

Currency markets responded largely as expected as the election results became clear, with the U.S. dollar rallying against nearly all major currencies. The primary drivers of USD strength have been the sharp rise in US bond yields making the USD more attractive to investors along with the surprising certainty of the election results eliminating the notion of the election results being slow to materialize.

The euro saw the steepest decline (-1.75%), as investors focused on yield differentials between the two regions, along with possible tariffs on European goods and increased security risks. Similarly, the Japanese yen (-1.5%), despite its safe-haven status, faced pressure due to concerns over a widening U.S.-Japan rate differential.

The British pound (-1.3%) fared somewhat better than the euro, reflecting its similar bond yields to the US along with a lower exposure to global demand fluctuations. Meanwhile, the Australian (-.67%) and New Zealand (-.65%) dollars, both of which are closely tied to Chinese demand, initially dropped but regained some ground later. As anticipated, these movements underscore the sensitivity of global currencies to shifting U.S. policies and market expectations.

In N. America, both the Canadian dollar and Mexican peso are weaker, led by the peso’s initial overnight fall (-2.5%) as traders mulled the potential impacts of Trump policies on trade. The CAD is -0.75% weaker and looking to retest its recent two your lows.

Central and Eastern European currencies were also battered, driven by concerns over European security and the sell-off in EUR/USD. The Hungarian forint (-2.0%) was the worst performer in the region, followed by the Polish zloty (-1.9%) and Czech koruna (-1.8%).

Asian currencies, particularly those with close trade ties to China, also saw sharp declines, with the Thai baht (-1.8%) and Malaysian ringgit (-1.4%) among the hardest hit. One of the main consequences of a second Trump term is likely to be a return to protectionist policies, with markets bracing for weaker growth in China due to Trump’s plans for 60% tariffs on Chinese imports. The yuan has also seen a sharp move, with CNY falling -1% and CNH off nearly -1.4% as China can bear the brunt of any possible Trump tariffs.

What’s Driving the U.S. Dollar Rally?

As we anticipated before the election, markets view another Trump term as bullish for the U.S. dollar. Here are the key factors behind the dollar’s recent surge:

Rising US bond yields – interest rate policy has been a driving force in currencies the past 2-3 years and the sharp spike in US yields since the start of October have driven the USD higher

Trump’s Push for Lower U.S. Tax Rates - Trump’s proposed tax cuts, likely to pass with a Republican Congress, are expected to boost U.S. economic growth, drive inflation, and prompt higher Federal Reserve interest rates—making the dollar more appealing

Increased Protectionism and Tariffs - These tariffs could signal weaker global growth under Trump, leading investors to favor lower-risk assets, like the dollar, while avoiding higher-risk currencies, particularly those tied to the global economic cycle.

Higher Geopolitical Uncertainty - A second Trump term could increase geopolitical uncertainty, which tends to dampen risk appetite. His stance on Ukraine is uncertain, and he has expressed less support for NATO

As these factors unfold, we’re likely to see the dollar retain its strength, reflecting investor expectations for policy shifts and global economic impacts.

What to expect in the coming days?

So far, currency market moves have been somewhat restrained compared to initial expectations. However, it’s still early, and we anticipate that volatility will remain elevated in the coming sessions as investors adjust their positions with another Trump presidency in mind.

This could mean renewed pressure on risk assets and continued dollar strength, especially if the Federal Reserve hints at upcoming policy meetings that the election outcome might slow the pace of rate cuts. Investors will be watching Thursday's Fed meeting closely for signals on how the election might influence future policy.

Sign up for Xe rate alerts to stay on top of any currency shifts in the coming days.

Save the Date

Post-election webinar: 12 November 2024

Join us for our post-election webinar on 12 November, “______ has won the US Election — Now What?”, where currency experts Richard Grace (Head of Corporate Sales, NAM) and Ron Vodicka (FX Sales and Dealing) will break down the election results and provide actionable insights on navigating FX and currency market volatility. Don’t miss this opportunity to prepare your business for the post-election landscape.

The content within this blog post is not intended for use as financial advice. This content is for informational purposes only.

Related Posts

December 3, 2024 — 4 min read

October 22, 2024 — 6 min read

October 15, 2024 — 5 min read

September 10, 2024 — 2 min read

August 13, 2024 — 3 min read

June 28, 2024 — 3 min read