Are There Risks to Conducting International Business in USD? Part 2: Importer and Exporter Scenarios

In the second part of our blog series on transacting international business in USD, we take a closer look on how it can impact importers and exporters.

24 de julio de 2020 — 6 min read

By Ron Vodicka, Corporate Sales Team Lead, North America

American companies continue to turn to international trade as a preferred method for growing sales or controlling costs. According to 2019 World Trade Organization data, international trade comprised 25% of the United States’ GDP, split between $3.1 trillion worth of imports and $2.6 trillion in exports.

Despite one-quarter of the U.S.’s GDP coming from international business, many American companies continue to transact all their international business in USD.

Why is this?

One primary reason is that certain industries have USD-functional supply chains – such as aspects of energy, agriculture and aerospace – have USD functional supply chains. Transacting in a foreign currency could be introducing FX risk.

However numerous other global industries are not USD-functional, and many American companies still choose to transact in USD.

Industry surveys reveal that two of the most common reasons cited are either:

A lack of FX risk awareness at the company

A management decision to transact in USD as this is easiest for their business.

Unfortunately, these decisions often result in the unintended consequence of transferring FX risk.

Keep in mind all international cross-border transactions, when the two counterparties have different functional currencies, have FX risk, even if priced in USD. One party must bear the FX risk and when an American company requests to transact in USD, that company is transferring the FX risk to the counterparty.

The Real Cost of Transacting in USD

To quantify the “cost” of transacting in USD, we’ve considered two trade scenarios:

A U.S. importer transacting in USD with both a Chinese and European supplier

A U.S. exporter selling in USD to both Chinese and European customers

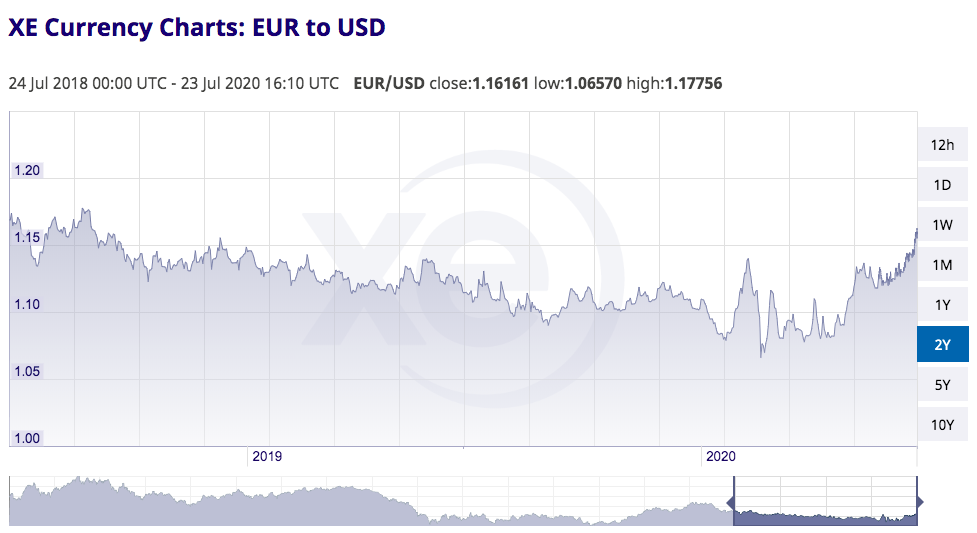

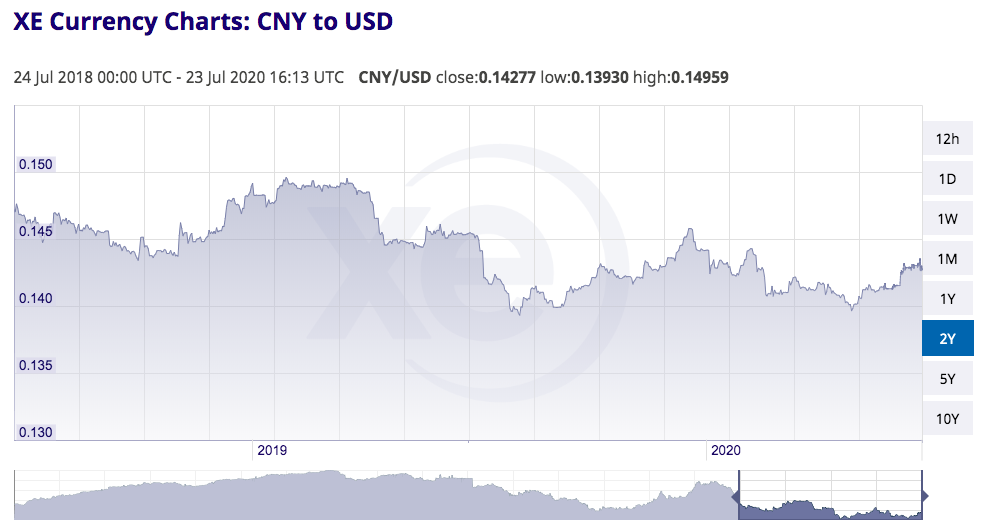

Looking at the 2-year EURUSD and USD-CNY charts below, the Chinese Yuan varied 12% against the USD and the EUR varied 10.2% versus the USD. This variance is the “cost” transferred to Chinese and European companies and it impacts both importers and exporters.

A Deeper Dive into Importers

U.S. importers cite many reasons for choosing to transact their international business in USD. Each of these reasons has merit and may be appropriate for a company’s unique situation.

Industry standard: certain industries have USD-functional supply-chains.

Ease of doing so: “we’ve always done it this way”.

No other options: a lack of multi-currency accounting systems.

Supplier’s choice: the supplier says it wants USD.

First-time global trader: pricing in USD to focus on other trade risks.

Regardless of the reason, it does not alter the reality that:

Paying for imports in USD to a foreign supplier that is not USD-functional is transferring FX risk to the supplier, and

The supplier will need to be compensated for taking on the FX risk, most likely padding their USD price.

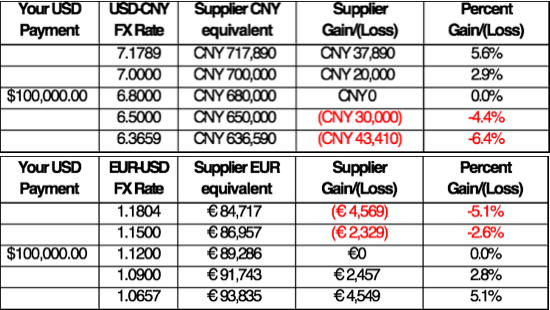

To illustrate the FX risk impact, the grid below shows the local currency impact of a USD payment to the Chinese and European suppliers.

Did this FX risk impact the pricing the American importers received?

Many importers report that their suppliers often change their USD prices—some say frequently—and almost always increase them. The most likely reason is FX. The supplier, converting the USD payable to local currency, is no longer receiving enough CNY or EUR to maintain their margins—thus, they ask for more USD. This most often happens when the USD weakens.

What Can a Company Do?

Many companies have adapted to this reality about FX risk even when paying in USD.

Some of the solutions we have seen in the marketplace include:

Companies asking for dual-currency invoices

Proactive companies paying suppliers in CNY or EUR, even if they are invoiced in USD

Companies asking for FX risk-sharing agreements

Companies embracing FX risk management and requesting local currency invoicing

A Deeper Dive into Exporters

Exporters also face the inherent FX risk in global trade as their end customers are most likely not USD-functional. Nonetheless, many U.S. companies still price their exports in USD. The most common reasons cited for this include:

Industry standard: i.e. USD-functional supply chain

No other options: accounting/ERP systems not multi-currency compatible

Convenience: ease of doing business to the American company’s staff

Again, regardless of the reason cited, it does not alter the reality that a company pricing its exports in USD is transferring the FX risk to the buyer. The buyer experiences the variability in the FX spot rates and will most likely:

Demand price discounts, or

Choose to buy from a competitor willing to price in their home currency

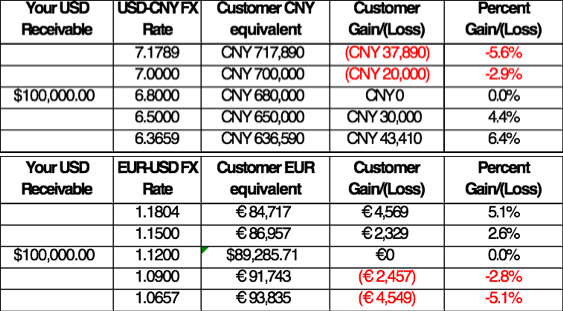

The grid below illustrates the FX risk impact transferred to the Chinese or European buyer over the last two years by the American exporter, as a result of pricing in USD.

Has this FX risk impacted your sales or revenue forecasts?

Many exporter sales staffs know that pricing in USD is often uncompetitive. Their biggest risk is a strengthening USD as this makes their product or service more expensive. An exporter’s sales management must weigh the costs versus benefits of transacting in USD. The risks are:

Uncompetitive pricing: a stronger dollar makes their product or service more expensive.

Payment delay risk: customers that don’t hedge may try to wait for the FX rate to improve.

Profit margin risk: sales teams may need to cut prices to close the sale.

Lost sales revenue: buyers may choose a similar product or service from competitor willing to price in local currency.

What Can a Company Do?

Many companies have recognized these market conditions and taken actions to adapt to their international customers’ needs. Strategies have included:

Offer pricing in local currency and take on management of FX risk

Offer hedging on behalf of suppliers that cannot

Offer risk-sharing pricing agreements

Open local sales offices to build stronger relationship

Wherever you are on this journey to transacting in foreign currencies, the Xe Corporate Team can be your partner and help your company manage its FX risk and international business.

Get in touch with an Xe expert and we’ll help you:

Analyze dual invoicing

Make and informed decision

Upskill your team and reap the benefits!

E: business.na@xe.com

P: +1-844-832-1367

Related Posts

29 de mayo de 2024 — 4 min read

14 de febrero de 2024 — 5 min read

19 de octubre de 2023 — 3 min read

18 de enero de 2023 — 7 min read

1 de diciembre de 2022 — 10 min read

16 de noviembre de 2022 — 10 min read