- Home

- Blog

- Personal Finance

- Going Cashless - Is Cash No Longer King of the Currency Realm?

Going Cashless - Is Cash No Longer King of the Currency Realm?

The concept of a cashless economy is quickly becoming reality. Discover countries leading the cash-free world and how XE is accelerating the pace.

7 febbraio 2019 — 4 min read

You're quite surprised when you go to the counter of an espresso bar and you see a sign which reads "Debit and Credit Card Payment Only, No Cash." Sadly, you have just returned from Westeros, and only have a tenner and 30 imitation Gold Dragon coins with you. No credit card, no debit card, and it seems - no beverage.

Your sword hand itches for battle, and you size up the purple-haired barista behind the counter. Surely he can not beat you in a duel, even though your sword is not made of Valyrian steel, but of foam rubber. But alas, it seems you forgot your weapon on the bus from the LARPing event.

Just as all hope seems lost, you find your smartphone in your waistcoat, purchase a Dragon Frappucino with a magical tap of your smartphone, and ride your bicycle home.

Cash has been king, sitting on the Transaction Throne for centuries. But it can not hold the throne much longer, as digital payments are the Danaerys Targaryen and Jon Snow of the payments world, and winter is coming.

Going Cashless Around the World

Sweden plans on phasing out cash entirely soon, and predicts by 2020, only about .5% of payments will be made in cash there. The American Banking Journal reports that about 60% of Americans believe they will see the end of cash payments within their lifetime.

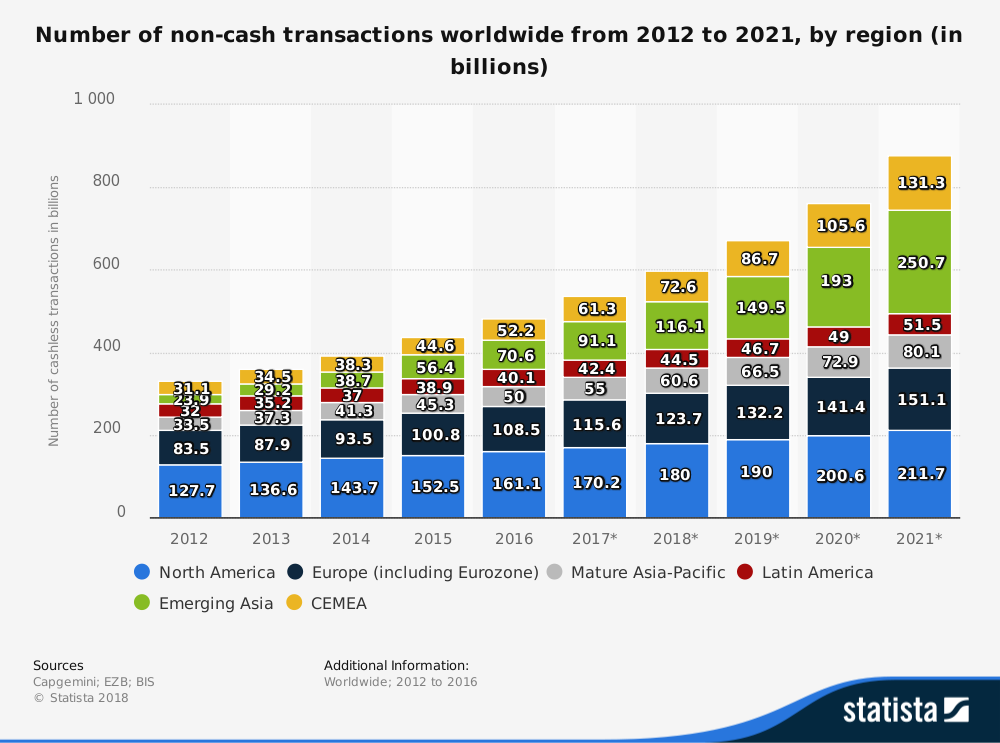

The infographic below provides some perspective about the growth of cashless transactions in countries around the globe.

The 2018 World Payments Report from Cap Gemini and BNP Paribas found that non-cash transactions are expected to accelerate at 12.7% CAGR (Compound Annual Growth Rate) until 2021. Robotic Process Automation and machine learning are helping to reduce payments fraud, and help Payment Service Providers like XE to mitigate fraud by monitoring systems that mitigate Money Laundering, fraud and data breaches.

Branchless banking is becoming more common, and many vending machines are accepting payments from credit cards and phone apps. In China, many street vendors are accepting payments via QR code devices for anything from clothing to candy. For expats, digital natives and tourists looking to minimize the risk of carrying cash, digital payments offer a convenient, secure alternative.

Data from Statista and Capgemini reports that by 2021, there will be over 150 billion non-cash transactions in Europe and over 211 million in North America. That includes transactions for e-commerce, credit card transactions and overseas money transfers.

Cashless Transaction Trends

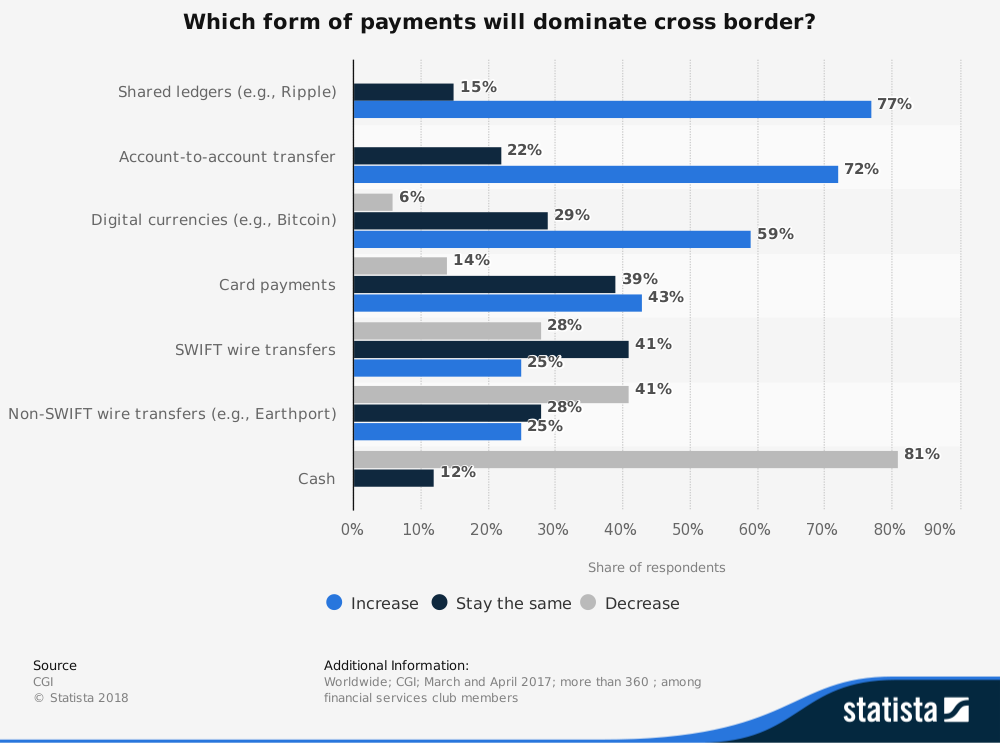

As far as cross-border non-cash payments, CGI predicts account-to-account transfers will be the highest growth trend, by 72% in 2022. Other wire transfers will also grow quickly, though their research predicts cash will rapidly decrease.

Cross-Border Payment Channel Changes by 2022

Are you a business owner, expat, or digital nomad that prefers to be on the leading edge of payment innovation? Would your life benefit from the convenience, security, and reliability of services from world's leading provider of cross-border money transfer?

Open a personal or business account today.

Please Note:

The information, materials, accompanying literature and documentation available on our internet site is for information purposes only and is not intended as a solicitation for funds or a recommendation to trade. XE, its officers, employees and representatives accept no liability whatsoever for any loss or damages suffered through any act or omission taken as a result of reading or interpreting any of the above information.

While we take reasonable care to keep the information on the website accurate and up to date, there may be occasions when this is not possible. Case Studies and articles are not intended to predict future moves in exchange rates or constitute advice.

XE makes no representations, warranties, or assurances as to the accuracy or completeness of any information derived from third party sources. If you are in any doubt as to the suitability of any foreign exchange product that you are intending to purchase from XE, we recommend that you seek independent financial advice first.

For more information about XE, please click here: Regulatory Information

Related Posts

23 dicembre 2024 — 11 min read

13 novembre 2024 — 3 min read

19 gennaio 2023 — 8 min read

18 gennaio 2023 — 8 min read

18 dicembre 2020 — 8 min read

2 dicembre 2020 — 8 min read