- Home

- Blog

- Money Transfer

- How to Protect Your International Money Transfers from Currency Volatility

How to Protect Your International Money Transfers from Currency Volatility

Living an international life doesn't have to be expensive. Five ways you can optimize your currency exchange rates.

17 de dezembro de 2018 — 4 min read

There are lots of reasons why people may send money around the world. For example, you might be:

Paying tuition fees to study abroad

Making payment for a vacation property

Purchasing a vintage sports car or custom motorcycle

Paying for a surgical procedure

Making overseas investments

Organizing a tropical destination wedding

You might think the only option for you is to visit your bank and ask them to send the money for you. But services such as XE offer specialized products and services for different scenarios, which could help to save you time and money or offer greater peace of mind.

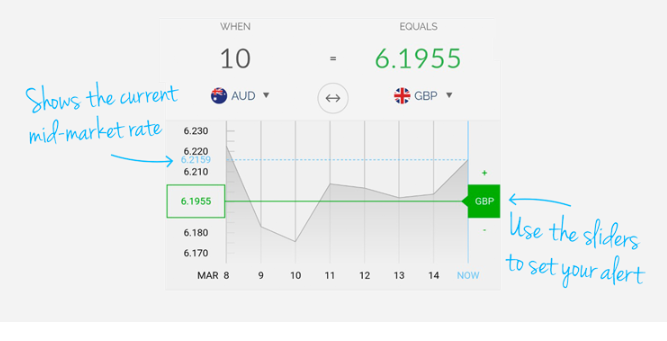

1. Rate Alerts

If you have a flexible timescale for when you make the transfer, such as expats living abroad who frequently send money to family at home, rate alerts can help you to spot a favorable rate. Instead of constantly checking the Currency Converter during turbulent times, you can define the mid-market rate which suits your budget best.

When the rate you're looking for becomes available, XE will send you an automated email to let you know.

How to Set a Rate Alert on the Xe.com Currency Converter application

2. Spot Orders

Need to make a transfer, or multiple transfers, right away but concerned the exchange rate might change against you before you complete your transaction? When you book an international money transfer with XE, the exchange rate you are offered is linked to the live foreign exchange markets and we make it clear what rate we are offering you. When the markets are open, the exchange rate you are offered will often fluctuate right up until the moment you confirm your transaction. Once you book the transfer, the exchange rate is secured, and we will complete the transfer once we have received payment from you.

3. Market Orders

Want to make a large transfer, but aren't pressed for a specific transfer day or time? Market orders allow you to select your preferred exchange rate and, once the rate you have selected becomes available, your transfer will be completed automatically. You can update or cancel market orders online at any time until the order is fulfilled.

4. Forward Contracts

Forward contracts can be useful if you know you are going to have a large transfer requirement in future, such as a property purchase, but you don't want to make the transfer straight away. You can secure the current exchange rate for up to 12 months with a small up-front deposit. This means you know exactly how much money you have in future, and you don't need to worry about currency fluctuations.

You can book a forward contract by calling your local XE office.

5. Currency Market Analysis

Interested in world news, and how it impacts currency valuations? Subscribe to the XE Currency Market Analysis and Currency Update e-mail newsletter services. This could help you to understand the forces that move the currency markets and be aware of periods of potential volatility that might impact your money transfer requirements.

Ready to get started?

Register for an XE Money Transfer account today to see if you could save time and money on your international money transfers.

Please note:

The information, materials, accompanying literature and documentation available on our internet site is for information purposes only and is not intended as a solicitation for funds or a recommendation to trade. XE its officers, employees and representatives accept no liability whatsoever for any loss or damages suffered through any act or omission taken as a result of reading or interpreting any of the above information.

While we take reasonable care to keep the information on the website accurate and up to date, there may be occasions when this is not possible. Case Studies and articles are not intended to predict future moves in exchange rates or constitute advice.

XE makes no representations, warranties, or assurances as to the accuracy or completeness of any information derived from third party sources. If you are in any doubt as to the suitability of any foreign exchange product that you are intending to purchase from XE, we recommend that you seek independent financial advice first.

For more information about XE, please click here: Regulatory Information

Related Posts

20 de dezembro de 2024 — 5 min read

6 de dezembro de 2024 — 7 min read

21 de novembro de 2024 — 8 min read

7 de novembro de 2024 — 8 min read

28 de outubro de 2024 — 6 min read

25 de outubro de 2024 — 6 min read