- Home

- Blog

- Currency News

- Currency Moves Caught You Off-Guard? You’re Not Alone.

Currency Moves Caught You Off-Guard? You’re Not Alone.

Since February 21, three of the most commonly used currencies by North American corporations (CAD, EUR and JPY) have seen moves of 3.6% to 9.5%.

10 mars 2020 — 3 min read

CAD, EUR, and JPY Updates

Ron Vodicka, Corporate FX Sales Team Lead

In the past few years, the financial markets had just about lulled participants to sleep. Equity markets delivered steady returns, interest rates remained low, and global currencies adhered to ranges and experienced relatively muted volatility. But that's no longer the case.

You’re not alone if you were jolted awake by all the recent market volatility. Few anticipated the unprecedented market movements of the past three weeks.

There was no definitive announcement on February 14 that in three weeks’ time:

US equity markets would plunge, taking the DJIA, Nasdaq, and S&P 500 all down nearly -25% at their lows,

The US Federal Reserve would execute a surprise 50 bp rate cut,

US 10-year and 30-year bonds would fall to record low yields, and

Oil prices would plummet -26% in**one day** after OPEC and Russia fail to reach an oil production accord.

Yet all of these events happened, leaving corporate finance departments, treasury groups, CFOs, and business owners to contend with the consequences.

Since February 21, three of the most commonly used currencies by North American corporations (CAD, EUR and JPY) have seen moves of 3.6% to 9.5%. Here’s a summary of the moves:

CAD -3.6% weaker against USD, trading above 1.3700 for the first time in nearly two years. What triggered this? The unexpected oil price plunge which was exacerbated by continued equity sell-off. Just three weeks ago, the CAD was at 1.3205.

EUR +6.1% against USD, trading at 1.1495 on March 9 after being at 1.0785 just three weeks ago. Exporters can enjoy both the 6% rise in spot and also the forward point premium, which makes locking in forward rates attractive. Importers have been left wondering what to do. Many decision-makers are frozen, hoping the spot rate will reverse. The charts remind us that just one year ago, EUR was at 1.1500 and two years ago 1.2400.

JPY +9.5% against USD, made more stunning as the JPY had a surprise 2% weakening to 112.00 on Feb 21 following weak GDP data, to only to be reversed dramatically by coronavirus safe-haven flows. These took the JPY to below 102.00 on March 9 with incredible speed. To quantify this, the FX option market which use FX Option volatility as a key measure, has seen 1-month JPY ATM option volatility spike nearly 10% (unheard of!) to 21.5% after being 11.8% on Friday.

What’s the takeaway from all this?

As a business, it's important to recognize that FX risk is real and has many potential impacts to your results. Regardless of whether your company benefited or was hurt by these market moves, FX risk can:

Raise import costs,

Reduce export sales margins,

Make your product less competitive, and

Possibly disrupt your 2020 business plans.

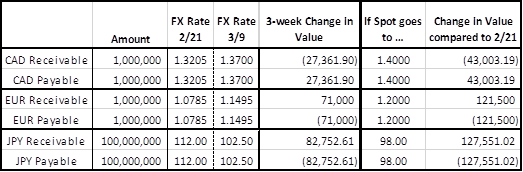

To illustrate the financial risk, here are example payables or receivables denominated in CAD, EUR, and JPY. There is the P/L impact looking at both 2/21 to 3/9 period, as well as considering if the currency trends continue:

If P/L swings of this magnitude cause you corporate nausea, please know you can take actions to mitigate them. FX volatility is a risk you can manage.

Feel free to give your Xe salesperson or Account Manager a call to discuss the markets and the FX risk management tools available to you for managing your currency risk.

Related Posts

7 mars 2025 — 5 min read

28 februari 2025 — 5 min read

13 februari 2025 — 7 min read

11 februari 2025 — 7 min read

4 februari 2025 — 4 min read

28 januari 2025 — 4 min read