- Home

- Blog

- Money Transfer

- Making International Online Payments to or From the USA

Making International Online Payments to or From the USA

Do you have family living in the USA, or are you preparing to move there? You're living an international life. Are you seeking a reliable, secure way to send money to your family abroad?

September 13, 2019 — 5 min read

Do you have family living in the USA, or are you preparing to move there? Perhaps you're an American citizen, with family or friends living abroad. You're living an international life.

Are you one of the many technology contractors working in the United States on an H-1B visa, and seeking a reliable, secure way to send money to your family abroad? You're definitely living an international life.

The United States is one of the world's two largest economies. The US dollar is the base currency against which all others are measured, though China and other countries have made moves to change that. When there are significant events happening in the US, or involving the USA in a big way (like the US-China trade tensions) currency values around the world is, in turn

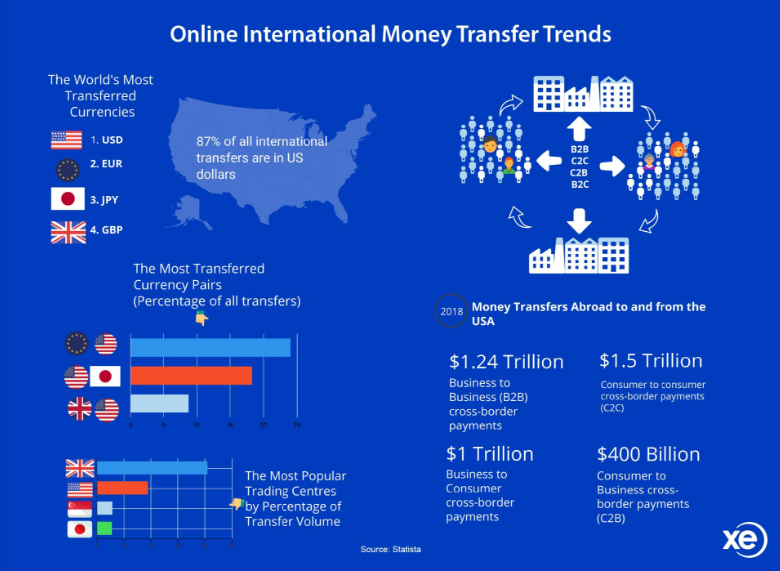

As you will see in the XE infographic below, 87% of international currency transfers involve the US dollar. Please read on for more insights below the infographic.

Statistics About Money Transfers to and From the USA, and in USD

International Money Transfer for Personal and Small Business Needs

Not all international lives are the globetrotting, pond hopping, jet setting, laptop lifestyling adventures that digital nomads and travel bloggers are famous for. International lives take many forms, and we strive to play a significant part in enriching them.

Do you have American business interests, or make business-related supplier payments to an American manufacturer, or pay a company to warehouse some offshore inventory? XE offers a broad portfolio of international payment services which meet the unique needs of individuals, small businesses and large enterprises across several industries.

There are many reasons why you would want to transfer money to the United States, and many cross-border payments service providers vying for your business.

Some of the advantages of entrusting XE to manage your international payments include:

XE sources real-time currency market values from central banks and other trusted institutions. You can access the latest market rates, set up rate alerts, and initiate trades from your desktop browser or mobile app.

XE offers businesses and individuals forward contracts which lock a specified foreign exchange rate for a designated period of time, for a specified amount. A forward contract requires you to trade for a specified amount within a defined timeframe, so coming to an agreement a suitable contract term length is important. businesses which are planning to make multiple or single

XE has low, transparent fees.

Our North American offices are staffed with friendly, knowledgeable customer service representatives for business-hour support (should you need it) during the day between Monday to Friday. and calls are routed to our other global offices after hours. We also provide support through Twitter, Facebook, or via email.

XE - Part of an International Group of Companies with A Strong American Presence

As you can clearly see, outbound transfers are increasing significantly, while inbound transfers are holding steady. There are many international money transfer companies which Americans, expats, and the rest of us can choose from.Yet since you're already here reading this article, we hope you that XE is the best choice to send money to US banks, because:

Our foreign exchange rates are fair, affordable, and based on the latest market rates

We meet the regulatory requirements of a specialized division of the US Treasury Department called FinCEN, otherwise known as the Financial Crimes Enforcement Network.

XE has over a quarter of a century of experience in the foreign exchange arena. We have offices in Austin, Texas and Los Angeles, California. Euronet Worldwide, our parent company, is located on the outskirts of Kansas City, Kansas.

XE can transfer US funds to any bank in the USA. American customers can easily send XE their American funds from their bank to our Bank of America account. We can then complete the international money transfer in one of 64 other currencies to over 140 worldwide destinations.

You have the option to transfer money to recipients that don't have an XE account, even in exotic currencies like the Hong Kong Dollar, Turkish Lira, or the South African Rand.

XE has been money transfer services between businesses and consumers for over a quarter century. We provide customer service from our offices in Los Angeles, Austin, and Toronto. Our technical teams have mapped our financial systems with bank-to-bank routes which can make for faster transfers. We comply with the financial regulatory requirements of every country where we provide our services.

Are you looking to transfer money internationally to a friend, relative or business in the United States? Or perhaps you are living in America, and looking for an affordable way to send money abroad. Either way, XE is an excellent choice for transferring American dollars, or exchanging them for other currencies for international remittances.

Sign up for an XE Money Transfer account and request a free, no obligation quote today. You'll be surprised at how much you can save compared to your bank.

Please Note:

The information, materials, accompanying literature and documentation available on our internet site is for information purposes only and is not intended as a solicitation for funds or a recommendation to trade. XE, its officers, employees and representatives accept no liability whatsoever for any loss or damages suffered through any act or omission taken as a result of reading or interpreting any of the above information.

While we take reasonable care to keep the information on the website accurate and up to date, there may be occasions when this is not possible. Case Studies and articles are not intended to predict future moves in exchange rates or constitute advice.

XE makes no representations, warranties, or assurances as to the accuracy or completeness of any information derived from third party sources. If you are in any doubt as to the suitability of any foreign exchange product that you are intending to purchase from XE, we recommend that you seek independent financial advice first.

For more information about XE, please click here: Regulatory Information

Related Posts

March 27, 2025 — 5 min read

March 21, 2025 — 8 min read

March 20, 2025 — 6 min read

March 12, 2025 — 7 min read

February 28, 2025 — 7 min read

February 27, 2025 — 7 min read